I'm a beginner/intermediate Python programmer but I haven't written an application, just scripts. I don't currently use a lot of object oriented design, so I would like this project to help build my OOD skills. The problem is, I don't know where to start from a design perspective (I know how to create the objects and all that stuff). For what it's worth, I'm also self taught, no formal CS education.

I'd like to try writing a program to keep track of a portfolio stock/options positions.

I have a rough idea about what would make good object candidates (Portfolio, Stock, Option, etc.) and methods (Buy, Sell, UpdateData, etc.).

A long position would buy-to-open, and sell-to-close while a short position has a sell-to-open and buy-to-close.

portfolio.PlaceOrder(type="BUY", symbol="ABC", date="01/02/2009", price=50.00, qty=100)

portfolio.PlaceOrder(type="SELL", symbol="ABC", date="12/31/2009", price=100.00, qty=25)

portfolio.PlaceOrder(type="SELLSHORT", symbol=开发者_如何学Go"XYZ", date="1/2/2009", price=30.00, qty=50)

portfolio.PlaceOrder(type="BUY", symbol="XYZ", date="2/1/2009", price=10.00, qty=50)

Then, once this method is called how do I store the information? At first I thought I would have a Position object with attributes like Symbol, OpenDate, OpenPrice, etc. but thinking about updating the position to account for sales becomes tricky because buys and sells happen at different times and amounts.

- Buy 100 shares to open, 1 time, 1 price. Sell 4 different times, 4 different prices.

- Buy 100 shares. Sell 1 share per day, for 100 days.

- Buy 4 different times, 4 different prices. Sell entire position at 1 time, 1 price.

A possible solution would be to create an object for each share of stock, this way each share would have a different dates and prices. Would this be too much overhead? The portfolio could have thousands or millions of little Share objects. If you wanted to find out the total market value of a position you'd need something like:

sum([trade.last_price for trade in portfolio.positions if trade.symbol == "ABC"])

If you had a position object the calculation would be simple:

position.last * position.qty

Thanks in advance for the help. Looking at other posts it's apparent SO is for "help" not to "write your program for you". I feel that I just need some direction, pointing down the right path.

ADDITIONAL INFO UPON REFLECTION The Purpose The program would keep track of all positions, both open and closed; with the ability to see a detailed profit and loss.

When I think about detailed P&L I want to see... - all the open dates (and closed dates) - time held - open price (closed date) - P&L since open - P&L per day

@Senderle

I think perhaps you're taking the "object" metaphor too literally, and so are trying to make a share, which seems very object-like in some ways, into an object in the programming sense of the word. If so, that's a mistake, which is what I take to be juxtapose's point.

This is my mistake. Thinking about "objects" a share object seems natural candidate. It's only until there may be millions that the idea seems crazy. I'll have some free coding time this weekend and will try creating an object with a quantity.

There are two basic precepts you should keep in mind when designing such a system:

- Eliminate redundancy from your data. No redundancy insures integrity.

- Keep all the data you need to answer any inquiry, at the lowest level of detail.

Based on these precepts, my suggestion is to maintain a Transaction Log file. Each transaction represents a change of state of some kind, and all the pertinent facts about it: when, what, buy/sell, how many, how much, etc. Each transaction would be represented by a record (a namedtuple is useful here) in a flat file. A years worth (or even 5 or 10 years) of transactions should easily fit in a memory resident list. You can then create functions to select, sort and summarize whatever information you need from this list, and being memory resident, it will be amazingly fast, much faster than a SQL database.

When and if the Transaction Log becomes too large or too slow, you can compute the state of all your positions as of a particular date (like year-end), use that for the initial state for the following period, and archive your old log file to disc.

You may want some auxiliary information about your holdings such as value/price on any particular date, so you can plot value vs. time for any or all holdings (There are on-line sources for this type of information, yahoo finance for one.) A master database containing static information about each of your holdings would also be useful.

I know this doesn't sound very "object oriented", but OO design could be useful to hide the detailed workings of the system in a TransLog object with methods to save/restore the data to/from disc (save/open methods), enter/change/delete a transaction; and additional methods to process the data into meaningful information displays.

First write the API with a command line interface. When this is working to your satisfaction, then you can go on to creating a GUI front end if you wish.

Good luck and have fun!

Avoid objects. Object oriented design is flawed. Think about your program as a collection of behaviors that operate on data (lists and dictionaries). Then group your related behaviors as functions in a module. Each function should have clear input and outputs. Store your data globally in each module. Why do it without objects? Because it maps closer to the problem space. Object oriented programming creates too much indirection to solve a problem. Unnecessary indirection causes software bloat and bugs.

A possible solution would be to create an object for each share of stock, this way each share would have a different dates and prices. Would this be too much overhead? The portfolio could have thousands or millions of little Share objects. If you wanted to find out the total market value of a position you'd need something like:

Yes it would be too much overhead. The solution here is you would store the data in a database. Finding the total market value of a position would be done in SQL unless you use a NOSQL scheme.

Don't try to design for all possible future outcomes. Just make your program work that way it needs to work now.

I think I'd separate it into

- holdings (what you currently own or owe of each symbol)

- orders (simple demands to buy or sell a single symbol at a single time)

- trades (collections of orders)

This makes it really easy to get a current value, queue orders, and build more complex orders, and maps easily into data objects with a database behind them.

To answer your question: You appear to have a fairly clear idea of your data model already. But it looks to me like you need to think more about what you want this program to do. Will it keep track of changes in stock prices? Place orders, or suggest orders to be placed? Or will it simply keep track of the orders you've placed? Each of these uses may call for different strategies.

That said, I don't see why you would ever need to have an object for every share; I don't understand the reasoning behind that strategy. Even if you want to be able to track your order history in great detail, you could just store aggregate data, as in "x shares at y dollars per share, on date z".

It would make more sense to have a position object (or holding object, in Hugh's terminology) -- one per stock, perhaps with an .order_history attribute, if you really need a detailed history of your holdings in that stock. And yes, a database would definitely be useful for this kind of thing.

To wax philosophical for a moment: I think perhaps you're taking the "object" metaphor too literally, and so are trying to make a share, which seems very object-like in some ways, into an object in the programming sense of the word. If so, that's a mistake, which is what I take to be juxtapose's point.

I disagree with him that object oriented design is flawed -- that's a pretty bold pronouncement! -- but his answer is right insofar as an "object" (a.k.a. a class instance) is almost identical to a module**. It's a collection of related functions linked to some shared state. In a class instance, the state is shared via self or this, while in a module, it's shared through the global namespace.

For most purposes, the only major difference between a class instance and a module is that there can be many class instances, each one with its own independent state, while there can be only one module instance. (There are other differences, of course, but most of the time they involve technical matters that aren't very important for learning OOD.) That means that you can think about objects in a way similar to the way you think about modules, and that's a useful approach here.

**In many compiled languages, the file that results when you compile a module is called an "object" file. I think that's where the "object" metaphor actually comes from. (I don't have any real evidence of that! So anyone who knows better, feel free to correct me.) The ubiquitous toy examples of OOD that one sees -- car.drive(mph=50); car.stop(); car.refuel(unleaded, regular) -- I believe are back-formations that can confuse the concept a bit.

I would love to hear with what you came up with. I am ~ 4 months (part time) into creating an Order Handler and although its mostly complete, I still have the same questions as you as I'd like it to be made properly.

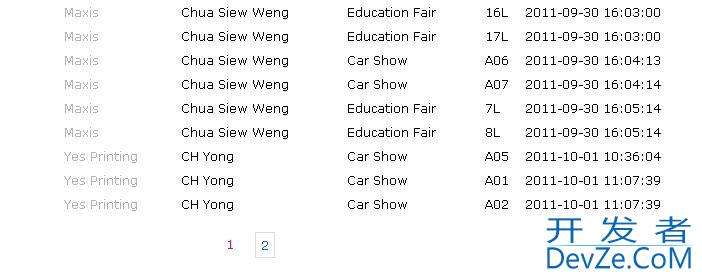

Currently, I save two files

A "Strategy Hit Log" where each buy/sell signal that comes from any strategy script is saved. For example: when the buy_at_yesterdays_close_price.py strategy is triggered, it saved that buy request in this file, and passes the request to the Order Handler

An "Order Log" which is a single DataFrame - this file fits the purpose you were focusing on.

- Each request from a strategy pertains to a single underlying security (for example, AAPL stock) and creates an Order which is saved as a row in the DataFrame, containing columns for the Ticker, the Strategy name that spawned this

Orderas well asSuborderandBroker Subordercolumns (explained below). - Each Order has a list of Suborders (dicts) stored in the Suborder column. For example: if you are bullish on AAPL, the suborders could be:

[

{'security': 'equity', 'quantity':10},

{'security': 'option call', 'quantity':10}

]

- Each Order also has a list of Broker Suborders (dicts) stored in the Broker Suborder column. Each Broker Suborder is a request to the Broker to buy or sell a security, and is indexed with the "order ID" that the Broker provides for that request. Every new request to the Broker is a new Broker Suborder, and canceling that Broker Suborder is recorded in that dict. To record modifications to Broker Suborders, you cancel the old Broker Suborder and send and record a new one (its the same commission using IBKR).

Improvements

List of Classes instead of DataFrame: I think it'd be much more pythonic to save each Order as an instance of an

Order_Class(instead of a row of a DataFrame), which hasSuborderandBroker_Suborderattributes, both of which are also instances ofSuborder_ClassandBroker_Suborder_Class. My current question is whether saving a list of classes as my record of all open and closed Orders is pythonic or silly.Visualization Considerations: It seems like Orders should be saved in table form for easier viewing, but maybe it is better to save them in this "list of class instances" form and use a function to tabularize them at the time of viewing? Any input by anyone would be greatly appreciated. I'd like to move away from this and start playing with ML, but I don't want to leave the Order Handler unfinished.

Is it all crap?: should each

Broker Suborder(buy/sell request to a Broker) be attached to anOrder(which is just a specific strategy request from a strategy script) or should allBroker Subordersbe recorded in chronological order and simply have a reference to the strategy-order (Order) that spawned theBroker Suborder? Idk... but I would love everyone's input.

![Interactive visualization of a graph in python [closed]](https://www.devze.com/res/2023/04-10/09/92d32fe8c0d22fb96bd6f6e8b7d1f457.gif)

加载中,请稍侯......

加载中,请稍侯......

精彩评论